Brands That Love Us

Why Opt For Wealth Management App?

Choosing our Wealth Management App empowers you to take control of your financial journey. Effortlessly track and optimize your investments, receive personalized advice, and stay informed on market trends. We prioritize your security, ensuring your sensitive information is safeguarded. Experience a personalized approach to wealth management, tailored to make your financial journey simpler and more informed. Your path to financial empowerment begins with our user-friendly app.

How Ajackus Can Make a Difference

Team Ajackus transforms your digital finance, offering solutions for peak performance. With industry expertise, effective collaboration, and a results-driven approach, we make a lasting difference in your online presence.

- Financial Planning Tools

- Investment Portfolio Management

- Risk Assessment and Mitigation

- Intelligent Asset Allocation Solutions

- Retirement Planning Features

- Tax Optimization and Reporting

- Automated Rebalancing Services

- Goal-Based Wealth Tracking

- Secure Client Data Encryption

- Customized Reporting and Analytics

- Estate Planning and Inheritance Management

- User-Friendly Client Interface

Why Collaborate with Us

Our software developers are dedicated to crafting customized solutions that foster innovation, enhance efficiency, and deliver optimal results for our clients.

Regulatory Compliance Solutions

We help you stay compliant with evolving financial regulations, ensuring your wealth management practices align with industry standards.

Advanced Reporting and Analytics

We provide access to comprehensive reports and analytics tools for informed decision-making and enhanced client insights.

Intelligent Automation

We leverage automated processes to streamline routine tasks, boosting operational efficiency and reducing manual errors.

User-Friendly Interface

We provide a user-friendly interface for clients and advisors, enhancing overall user experience and accessibility.

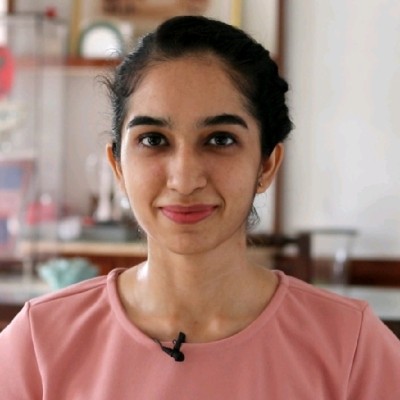

What our Clients are Saying

23 Reviews

FAQs

Wealth management software acts like a financial companion, simplifying tasks such as tracking investments and managing portfolios. It helps automate processes, giving a real-time snapshot of your assets, risks, and opportunities. Think of it as a tool to make financial decisions more straightforward and optimize your wealth growth.

In wealth management, you get a range of services tailored to your unique needs. This includes personalized financial plans, investment management, retirement and tax planning, and even estate management. It’s like having a personal guide to navigate your financial journey.

Wealth management harnesses technologies like AI, machine learning, and data analytics to make things simpler. These technologies work in the background to enhance how your portfolio is managed, making everything more efficient and helping you make informed decisions.

Wealth management comes in various types, each catering to specific financial needs. There’s private wealth management, investment advisory, estate and retirement planning, and even tax planning. It’s like having a toolkit with different tools for different tasks, ensuring all aspects of your finances are covered.

FinTech, or Financial Technology, is like the wizard behind the curtain in wealth management. It’s the reason you can access your financial information easily and make transactions seamlessly. FinTech makes wealth management user-friendly and accessible, like having a tech-savvy friend guiding you through your financial choices.

AI in wealth management acts as a smart assistant, analyzing vast amounts of financial data to identify trends and investment opportunities. It helps in creating personalized investment strategies, automates routine tasks, and provides real-time insights. Think of it as having a knowledgeable advisor who continuously monitors the market and tailors recommendations based on your financial goals.

No, wealth management is not a bank. Wealth management refers to a set of financial services that involve personalized planning, investment advice, and other financial strategies to help individuals grow and manage their wealth effectively. While banks may offer wealth management services, they are distinct entities. Wealth management focuses on individual financial goals and holistic financial planning rather than traditional banking functions like deposits and loans.